A lithium battery is a type of battery using a lithium metal or a lithium alloy as a negative electrode material and a nonaqueous electrolyte solution. Lithium batteries are mainly used in digital products in the traditional field, and are mainly used in the field of power batteries and energy storage in emerging fields.

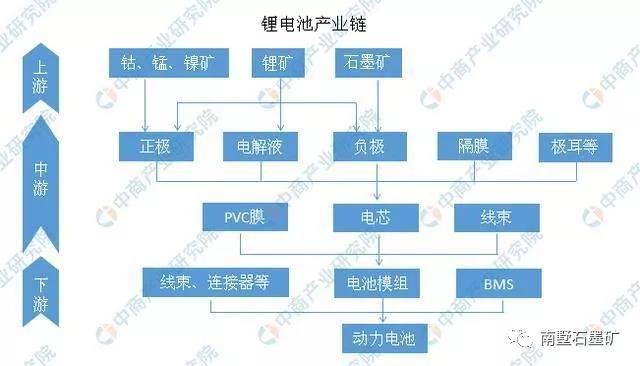

China has abundant lithium resources and a complete lithium battery industry chain, as well as a huge base of talents, making China the most attractive region in the development of lithium batteries and materials industry, and has become the world’s largest lithium. Battery material and battery production base. The upstream of the lithium battery industry chain includes cobalt, manganese, nickel ore, lithium ore, and graphite ore. In the lithium battery manufacturing industry chain, the core part of the battery pack is the battery core. After the battery core is packaged, the wiring harness and the PVC film are integrated to form a battery module, and then the wire harness connector and the BMS circuit board are added to form a power battery product.

Upstream analysis of the industrial chain

The upstream of the lithium battery is the mining and processing of raw material resources, mainly lithium resources, cobalt resources and graphite. Three raw material consumption of electric vehicles: lithium carbonate, cobalt and graphite. It is understood that the global lithium resource reserves are very rich, and currently 60% of the lithium resources have not been explored and developed, but the distribution of lithium mines is relatively concentrated, mainly distributed in the “lithium triangle” region of South America, Australia and China.

At present, the global reserves of drilling are about 7 million tons, and the distribution is concentrated. The reserves of Congo (DRC), Australia and Cuba account for 70% of the global reserves, especially the Congo’s reserves of 3.4 million tons, accounting for more than 50% of the world. .

Midstream analysis of lithium battery industry

The middle of the lithium battery industry chain mainly involves various positive and negative materials, as well as electrolytes, tabs, diaphragms and batteries.

Among them, the lithium battery electrolyte is a carrier for driving lithium ions in a lithium ion battery, and plays an important role in the operation and safety of the lithium battery. The working principle of lithium-ion battery is also the process of charging and discharging, that is, the lithium ion is shuttled between the positive and negative electrodes, and the electrolyte is the medium for lithium ion flow. The main function of the diaphragm is to separate the positive and negative electrodes of the battery, prevent the two poles from contacting and short-circuit, and also have the function of passing electrolyte ions.

Downstream analysis of lithium battery industry chain

In 2018, the output of China’s lithium-ion battery market increased by 26.71% year-on-year to 102.00GWh. China’s global production accounted for 54.03%, and it has become the world’s largest lithium-ion battery manufacturer. Lithium battery representative companies are: Ningde era, BYD, Waterma, Guoxuan Hi-Tech and so on.

From the downstream application market of lithium-ion batteries in China, the power battery in 2018 was driven by the rapid development of the new energy automobile industry. The output increased by 46.07% year-on-year to 65GWh, which became the largest segment; the 3C digital battery market in 2018 The growth was stable, and the output decreased by 2.15% year-on-year to 31.8GWh, and the growth rate decreased. However, the high-end digital battery field represented by flexible batteries, high-rate digital batteries and high-end digital soft packs is subject to wearable devices, drones, and high-end intelligence. Driven by market segments such as mobile phones, it has become a relatively high-growth part of the 3C digital battery market; in 2018, China’s energy storage lithium-ion batteries increased slightly by 48.57% to 5.2GWh.

Power Battery

In recent years, China’s power lithium-ion battery has developed rapidly, mainly due to the strong support of national policies for the new energy automobile industry. In 2018, the output of China’s new energy vehicles increased by 50.62% year-on-year to 1.22 million units, and the output was 14.66 times that of 2014. Driven by the development of new energy vehicle market, China’s power battery market maintained rapid growth in 2017-2018. According to research statistics, the output of China’s power battery market in 2018 increased by 46.07% year-on-year to 65GWh.

With the official implementation of the new energy vehicle points system, traditional fuel vehicle companies will increase the layout of new energy vehicles, and foreign companies such as Volkswagen and Daimler will jointly build new energy vehicles in China. The demand for China’s power battery market will be Maintaining the trend of rapid growth, it is expected that the CAGR of power battery production will reach 56.32% in the next two years, and the power battery output will exceed 158.8GWh by 2020.

China’s lithium-ion battery market has maintained rapid growth, mainly driven by the rapid growth of the power battery market. In 2018, the top five enterprises in China’s power battery market accounted for 71.60% of the output value, and the market concentration was further improved.

The future power battery is the largest growth engine in the field of lithium-ion batteries. Its trend toward high energy density and high safety has been determined. Power batteries and high-end digital lithium-ion batteries will become the main growth points in the lithium-ion battery market, and lithium batteries within 6μm. Copper foil will be one of the key raw materials for lithium-ion batteries and will become the focus of mainstream enterprises.

3C battery

In 2018, China’s digital battery production fell by 2.15% year-on-year to 31.8GWh. GGII expects that the digital battery CAGR will be 7.87% in the next two years. It is estimated that China’s digital battery production will reach 34GWh in 2019. By 2020, China’s digital battery production will reach 37GWh, and high-end digital soft pack batteries, flexible batteries, high-rate batteries, etc. will be driven by high-end smart phones, wearable devices, drones, etc., becoming the main growth of the digital battery market. point.

Energy storage battery

Although China’s energy storage lithium-ion battery field has huge market space, it is still limited by cost and technology, and is still in the market introduction period. In 2018, the output of China’s energy storage lithium-ion batteries increased by 48.57% year-on-year to 5.2GWh. It is estimated that the output of China’s energy storage lithium-ion batteries will reach 6.8GWh in 2019.

Post time: Sep-20-2019